Weekly Market: Data That Matter

In this week's market highlight...

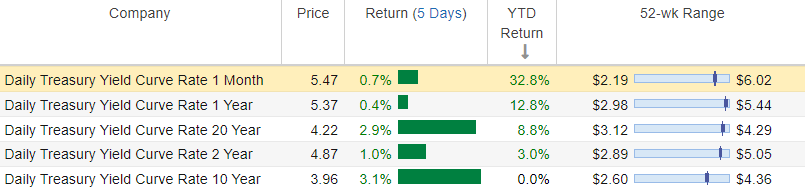

- Bond market

- Fed Funds Rate Upper Limit: 5.50% (+25 bps)

- 10-Year Yield Curve: 3.96% (+3.1%)

- 2-Year Yield Curve: 4.87% (+1.0%)

- 10-2 Year Yield Spread: -91

- Stock Market

- S&P 500: 4,582 (+1.0%)

- Nasdaq: 14,316 (+2.0%)

- XLC (Communication Services): +5.0%

- XLU (Utilities): -2.1%

- Commodity market

- Crude Oil: +4.7%

- Copper: +3.4%

- Soybeans: -7.7%

- Sugar: -4.4%

Watch for the 'Screaming Screeners' section to uncover hidden opportunities and make well-informed investment choices.

Market Snapshot

** Regrettably, I had to liquidate my investments, but I am now reentering in May 2023 in to world of investment. **

Bonds

Yield Curve Rate

ETFs

Equities

S&P 500

Sector

ETFs

Commodity

Economic Data

Federal Funds Effective Rate

Frequency: Monthly

10-Year minus 2-Year Treasury Yield Curve

Frequency: Daily

10-Year Treasury Yield Curve

Frequency: Daily

| Jul 27, 2023: 4.01% |

Aaa Corporate Yield

Frequency: Daily

| Jul 26, 2023: 4.70% |

Unemployment Rate

Frequency: Monthly

Comments

Post a Comment