In this week's market highlight...

- Stock Market

- S&P 500: -1.2%

- Health Care: -2.8%

- Bond market

- 10-Year Yield Curve: +6.6%

- 20-Year Yield Curve: +5.2%

- 2-Year Yield Curve: +1.4%

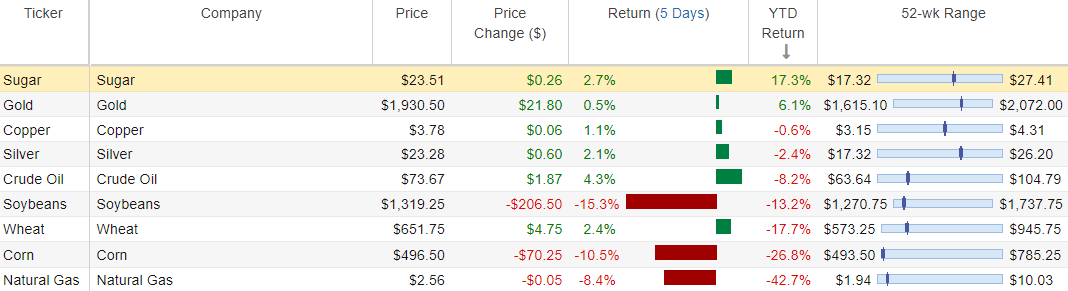

- Commodity market

- Corn: -10.5% (yearly down by -26.8%)

- Soybeans: -15.3% (yearly down by -13.2%)

Watch for the 'Screaming Screeners' section to uncover hidden opportunities and make well-informed investment choices.

Market Snapshot

Portfolio Allocations and Performance

|

Account #1 Account #2

|

|

| Account #1 (Blue), Account #2 (Green), S&P 500 (Red) |

Bonds

Yield Curve Rate

Equities

S&P 500

Sector

ETFs

Commodity

Economic Data

Federal Funds Effective Rate

Frequency: Monthly

|

| Jun 2023: 5.08% |

10-Year minus 2-Year Treasury Yield Curve

Frequency: Daily

|

| Jul 07, 2023: -0.88% |

10-Year Treasury Yield Curve

Frequency: Daily

|

| Jul 07, 2023: 4.05 |

Aaa Corporate Yield

Frequency: Daily

|

| Jul 07, 2023: 4.88 |

Unemployment Rate

Frequency: Monthly

|

| May 2023: 3.7% |

PCE Inflation Rate

Frequency: Monthly

|

| May 2023: 4.61% |

Rail Freight Intermodal Traffic

Frequency: Monthly

|

Apr 2023: 1,005,278 units

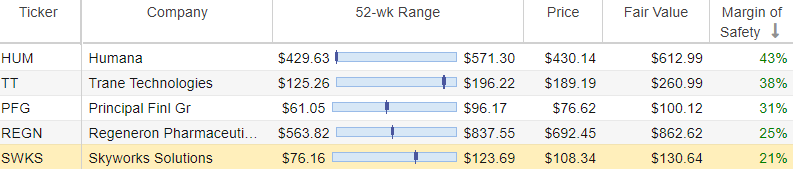

Screaming Screeners

Data Sources: Economic data sourced from Federal Reserve Economic Data (FRED) by the Federal Reserve Bank of St. Louis. Market data and charts obtained from StockRover. |

Comments

Post a Comment